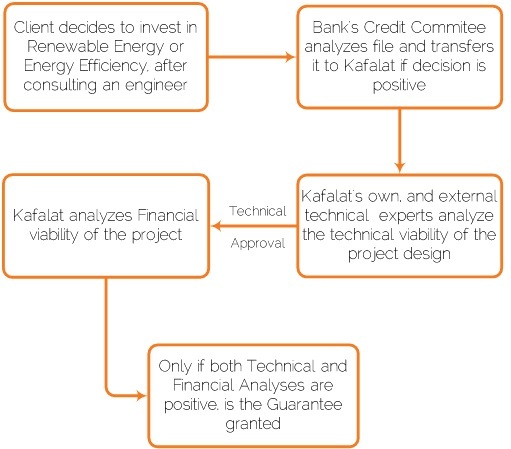

Application flow

Application flow

To facilitate the Client’s application process, the application will be divided into 2 parts, a technical part comprising the Technico-Financial Study, and an economic part comprising all other documents. The flowchart below illustrates the application flow from the Client’s decision to explore energy investment opportunities, to the final approval of the loan and guarantee.